Paypal Business Loan for Beginners

Top Guidelines Of Paypal Business Loan

Table of ContentsThe Greatest Guide To Paypal Business LoanUnknown Facts About Paypal Business LoanPaypal Business Loan for DummiesGet This Report on Paypal Business Loan

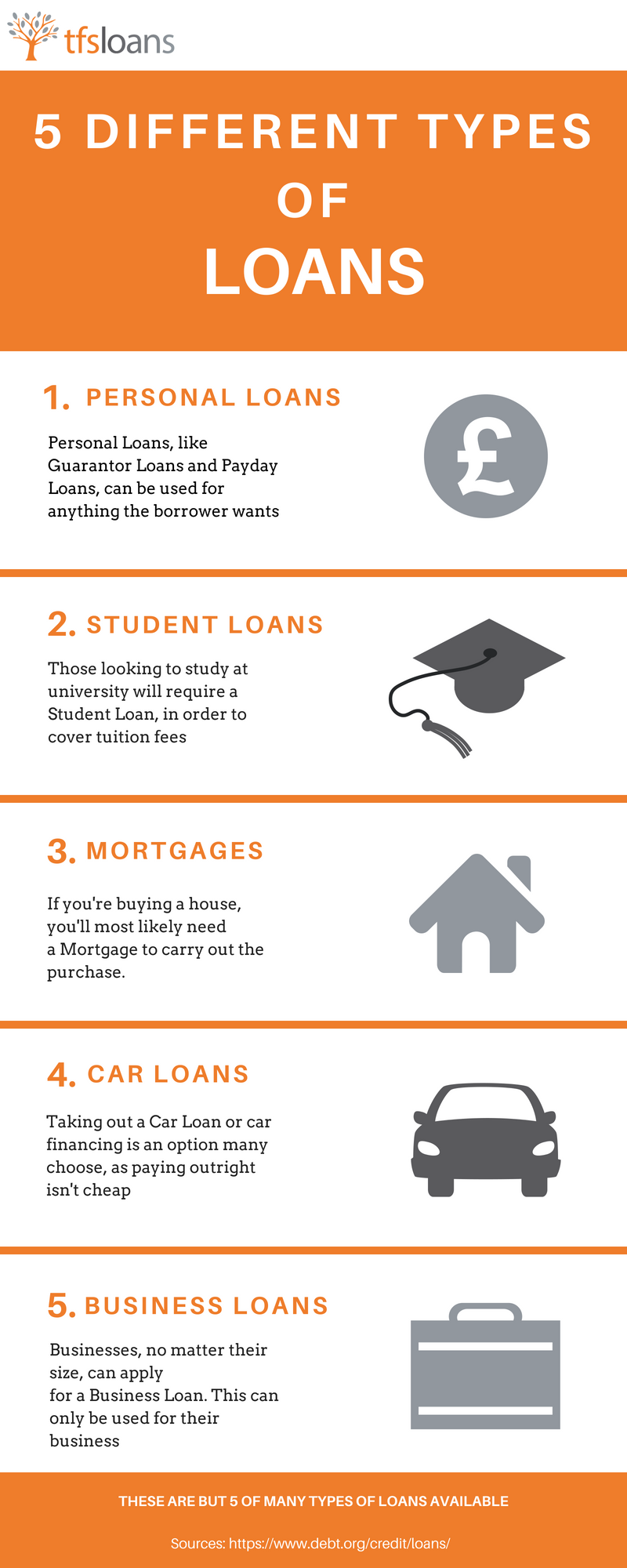

The SBA functions as the guarantor between the borrower as well as the lending institution (PayPal Business Loan). In return, loan providers offer their terms, rates of interest caps and also other requirements which call for approval from the SBA.The SBA uses different plans and you can pick any plan which could fit your organization requirementfor instance, acquiring inventory, paying financial obligations or home mortgages, expanding your business, or perhaps for getting actual estate.SBA fundings do call for a complete application procedure, an individual debt check, and security demands, so they aren't right for every person. When you listen to words "car loan," a term financing from a significant financial institution is probably one of the first things that comes to mind. A term funding is specified as a swelling sum, paid to a customer with a contract to repay it over a set duration of time, with rate of interest - PayPal Business Loan.

All you need to do is to remain within that credit rating limitation. Utilize your credit report sensibly as well as make timely monthly payments, and you can use the credit rating amount as often times as you like while developing a positive credit rating for your service. Entrepreneur who do not have collateral or a solid sufficient credit rating to acquire term fundings can count on business charge card for quick financing.

Financial debt spiral risk: It is simple for balances as well as interest to accumulate if you are not able to make your monthly payments promptly. If you miss out on one payment, the overdue balance rolls over to the next settlement period, and also you will be billed rate of interest on the new amount, indicating your next repayment will be greater.

Paypal Business Loan Fundamentals Explained

This can quickly produce an ever-increasing opening of debt and also it's extremely difficult to climb up out without a large infusion of money. Credit report restrictions: All company bank card come with restrictions, and staying within your limitation can often confirm to be a headache. You might get around this by utilizing several cards, or you may have the ability to negotiate higher limitations gradually.

When it comes to credit scores cards, you're at the grace of the credit service provider. Can't use it for all kinds of payments: Local business owners that need fast funding to make payroll or pay rental fee generally can not utilize credit cards to make these particular sorts of settlements. Based upon your individual credit score: Also most organization credit cards are still connected to business proprietor's individual credit score.

One advantage of a Vendor Cash Advance is that it is relatively very easy to acquire. Another advantage is that straight from the source local business owner can obtain the money within a couple of days. Nevertheless, it is not suitable for companies which have few credit score card deals, because they will not have sufficient transaction quantity to get approved.: In invoice factoring, the loan provider buys overdue invoices from you as well as gives you a lot of the invoice quantity upfront.

Invoice factoring permits you to receive the cash that you need for your service without awaiting your clients to pay. The only concern with this sort of tiny company funding is that a bulk of your company revenue should originate from slow-moving paying invoices. You need to also have solid credit rating and a track document of consistently-paying clients.

The Basic Principles Of Paypal Business Loan

Allow's take a detailed check out exactly how Fundbox works in order to recognize why it can be a great choice for your business funding. Right here are some things to learn about Fundbox: Decision within hrs: You can sign up online in seconds and obtain a credit choice in hours. As soon as you make a decision to sign up, all you have to do is connect your audit software application or company checking account with Fundbox.

As a small organization proprietor, you know that there are a great deal of financing options out there. Take right into factor to consider the following information regarding your service prior to making your following move: Personal debt rating: Take an appearance at your individual credit rating rating.

7 Simple Techniques For Paypal Business Loan

If your credit rating is ordinary or low, then you will possibly need to pay higher interest prices or you might be denied totally. Service credit: Make certain that your company has a great credit report, as the loan providers will take your service debt right into consideration before approving it for a lending.

Organization income: The borrowing choices will certainly differ depending on the way your business creates profits. It used to be that a significant bank was one of your only options for obtaining accessibility to a business line of credit report, you can try here but not anymore - PayPal Business Loan.